SUBSCRIBE

Enter your Name and Email address to get

the tax guide delivered to your inbox.

Please include name of person that directed you to my online tax guide so I can thank them personally.

24961 The Old Road, 2nd Floor

Stevenson Ranch, CA 91381

Phone: 661-286-1040

Fax: 661-286-1050

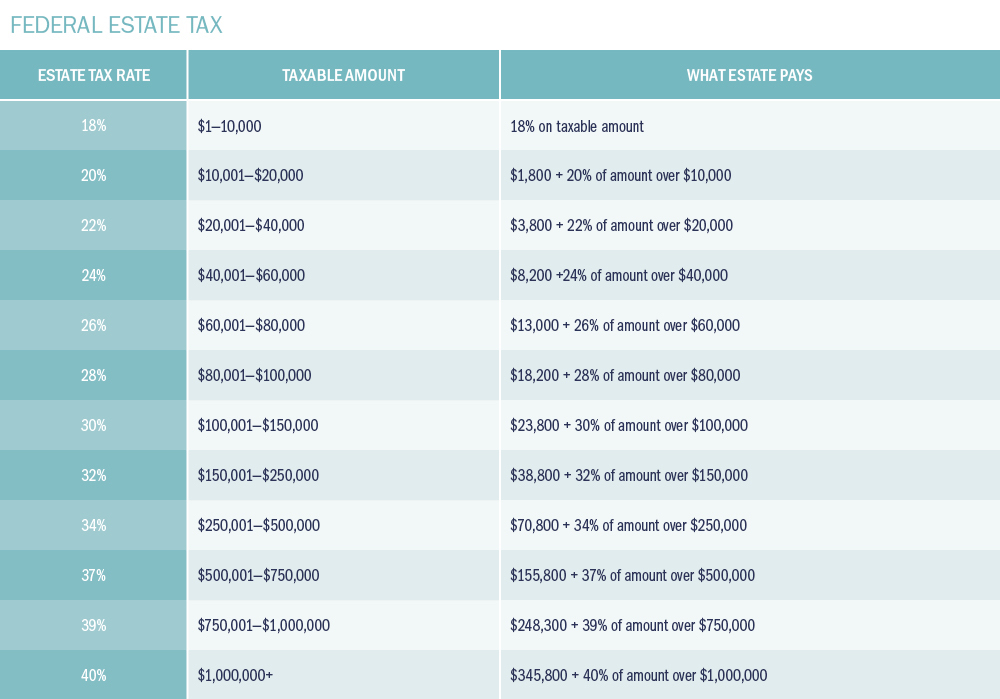

If you haven’t discussed estate planning opportunities with your legal, tax, and financial professionals yet, why not use this time to schedule a meeting? Even with more generous federal estate tax exemptions, you need to be aware of local estate and inheritance taxes. Although some states have repealed their estate tax statutes and others increased their exemptions recently, a few still have the tax. A handful of states also have an inheritance tax.

Annual gifting can prove an effective estate transfer strategy. If, for example, you and your spouse each max out your annual gift exemption to two children and two grandchildren, you’ll avoid gift tax and preserve your entire estate tax exemption. In this example, a couple could gift $144,000 tax-free per year. Be sure, however, to use your annual exemption by December 31 because it doesn’t carry over from year to year.

A caution: generally, spouses who are both U.S. citizens may transfer unlimited amounts to each other without incurring any gift tax, as any assets in excess of the couple’s combined estate tax exemption will be taxed at the death of the surviving spouse, and transferring assets to the survivor defers the tax that the IRS will eventually collect.

Gifts to a non-US citizen spouse, however, are limited. Since a non-US citizen spouse may not be subject to the U.S. estate tax, one cannot transfer unlimited assets to a non-US citizen spouse since that transferred wealth could potentially avoid U.S. estate taxation upon the non-US citizen spouse’s death. Thus, when the recipient spouse is not a U.S. citizen, and regardless of whether the non-US citizen spouse is a resident or nonresident of the United States, the amount of tax-free gifts is limited to an annual exclusion amount. For calendar year 2024, the first $185,000 of gifts to a spouse who is a non-US citizen are not included in the total amount of taxable gifts.

A caution, though: In 2023, the IRS released its Revenue Ruling 2023-2, which clarifies that transferring assets to an irrevocable trust, a popular strategy for transferring a family home, can take the trust assets out of the grantor’s estate for all purposes. If the asset is no longer part of the grantor’s taxable estate, it will not qualify for a step-up in basis. This means the assets in your irrevocable trust keep the same basis as when they are transferred to the next generation—or maybe to multiple generations. Be sure to review your trust arrangement with your estate professional.

The ten-year rule also applies to trusts that receive IRA assets on behalf of beneficiaries, except for certain trusts named as an IRA beneficiary. Beware that a conduit trust must forward all IRA income to income beneficiaries, potentially exposing the inherited IRA assets to heirs’ creditors and any bankruptcy or divorce proceedings.

You should consult an attorney to determine if you’ll need to redraft the conduit trust to allow the trust to retain the assets rather than distribute income to beneficiaries. However, distributing assets this way typically results in less favorable trust tax rates. You should review your estate plan documents with an attorney if you have significant assets in retirement accounts with non-spousal beneficiaries.

Enter your Name and Email address to get

the tax guide delivered to your inbox.

Please include name of person that directed you to my online tax guide so I can thank them personally.

Enter your Name, Email Address and a short message. We'll respond to you as soon as possible.

Stern Kory Sreden & Morgan and LTM Marketing Solutions, LLC are unrelated companies. This publication was prepared for the publication’s provider by LTM Marketing Solutions, LLC, an unrelated third party. Articles are not written or produced by the named representative.

The information and opinions contained in this web site are obtained from sources believed to be reliable, but their accuracy cannot be guaranteed. The publishers assume no responsibility for errors and omissions or for any damages resulting from the use of the published information. This web site is published with the understanding that it does not render legal, accounting, financial, or other professional advice. Whole or partial reproduction of this web site is forbidden without the written permission of the publisher.