SUBSCRIBE

Enter your Name and Email address to get

the tax guide delivered to your inbox.

Please include name of person that directed you to my online tax guide so I can thank them personally.

24961 The Old Road, 2nd Floor

Stevenson Ranch, CA 91381

Phone: 661-286-1040

Fax: 661-286-1050

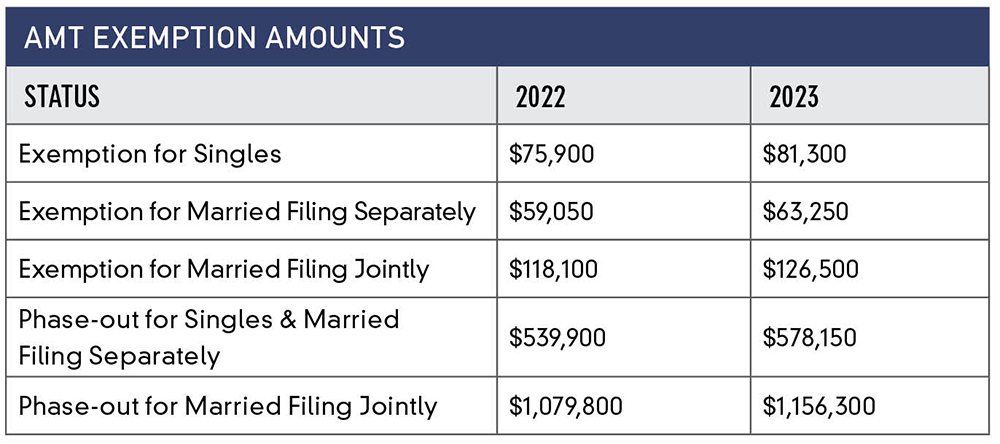

The exemption for taxpayers subject to the Alternative Minimum Tax (AMT), which limits allowable deductions for some higher-income taxpayers, increased significantly in 2023. If you believe your taxable income could trigger the AMT, increasing tax-deferred contributions to qualified retirement plans could help lower your AMT or even help you avoid the alternative tax altogether.

Enter your Name and Email address to get

the tax guide delivered to your inbox.

Please include name of person that directed you to my online tax guide so I can thank them personally.

Enter your Name, Email Address and a short message. We'll respond to you as soon as possible.

Stern Kory Sreden & Morgan and LTM Marketing Solutions, LLC are unrelated companies. This publication was prepared for the publication’s provider by LTM Marketing Solutions, LLC, an unrelated third party. Articles are not written or produced by the named representative.

The information and opinions contained in this web site are obtained from sources believed to be reliable, but their accuracy cannot be guaranteed. The publishers assume no responsibility for errors and omissions or for any damages resulting from the use of the published information. This web site is published with the understanding that it does not render legal, accounting, financial, or other professional advice. Whole or partial reproduction of this web site is forbidden without the written permission of the publisher.