SUBSCRIBE

Enter your Name and Email address to get

the tax guide delivered to your inbox.

Please include name of person that directed you to my online tax guide so I can thank them personally.

Anthony J. Penree

President

LTM Marketing Solutions, LLC

1060 Broadway #1161

Albany, NY 12204

Phone: 800-243-5334

Fax: 800-720-0780

Email: apenree@ltmclientmarketing.com

Website: ltmclientmarketing.com

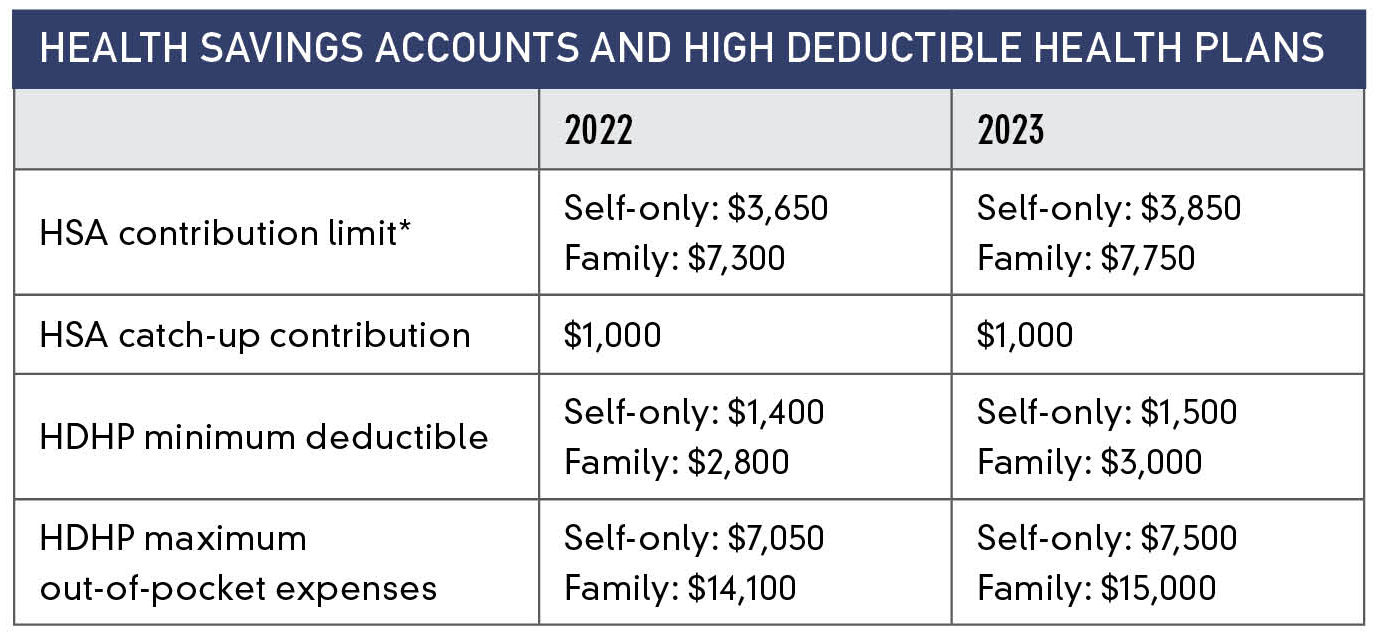

Limits for Health Savings Accounts (HSAs) and their companion High-Deductible Health Plans (HDHPs) increased significantly for 2023, thanks to high inflation.

*Combined employer and employee contributions

The ability of HDHPs to provide first-dollar coverage for remote health care services was extended through 2022, but will expire in 2023 unless Congress acts to continue this benefit.

*Nonqualified withdrawals incur a tax penalty before age 65. After reaching 65, you can take penalty-free withdrawals for any reason, but must pay income tax on the nonqualified amount.

Enter your Name and Email address to get

the tax guide delivered to your inbox.

Please include name of person that directed you to my online tax guide so I can thank them personally.

Enter your Name, Email Address and a short message. We'll respond to you as soon as possible.

The information and opinions contained in this web site are obtained from sources believed to be reliable, but their accuracy cannot be guaranteed. The publishers assume no responsibility for errors and omissions or for any damages resulting from the use of the published information. This web site is published with the understanding that it does not render legal, accounting, financial, or other professional advice. Whole or partial reproduction of this web site is forbidden without the written permission of the publisher.