SUBSCRIBE

Enter your Name and Email address to get

the tax guide delivered to your inbox.

Please include name of person that directed you to my online tax guide so I can thank them personally.

Anh Le, CPA, CGMA, EA, MBA

12400 Olive Blvd, Suite 320

Creve Coeur, MO 63141

Phone: 314-624-0350

Fax: 314-624-0351

Email: anh@anhlecpa.com

Website: www.lecpafirm.com

Health Savings Accounts

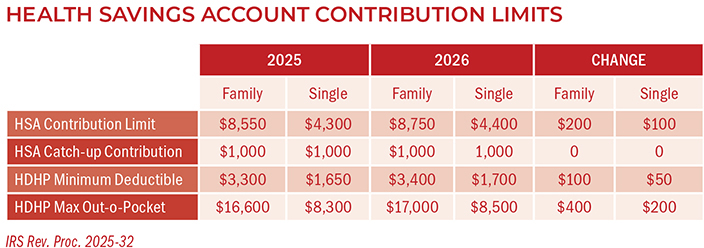

HSAs are triple tax-advantaged with tax-deferred contributions, tax-free potential earnings, and tax-free withdrawals for qualified medical expenses. You can roll over any balance you had left at year-end 2025 to 2026. Nonqualified withdrawals made before age 65 are subject to a tax penalty. After reaching 65, you can take penalty-free withdrawals for any reason but must pay income tax on the nonqualified amount. To save in an HSA, you must have a high-deductible health plan (HDHP).

OBBBA made changes that expand the health plans that qualify as HDHPs. First, it extends the rule allowing plans to be considered HDHPs, despite not having a deductible for telehealth services retroactively to January 1, 2025. Second, OBBBA expands HSA eligibility to include those enrolled in Bronze and Catastrophic plans available on state and federal insurance exchanges under the Affordable Care Act. This provision takes effect on January 1, 2026. And third, it allows individuals with HDHPs to enroll in Direct Primary Care arrangements (sometimes referred to as "concierge medical care") while remaining HSA eligible, provided the monthly fee for DPC services doesn't exceed $150 for individuals or $300 for families (both adjusted for inflation). DPC fees are also considered qualified medical expenses that can be paid with HSA funds. This provision takes effect on January 1, 2026.

Enter your Name and Email address to get

the tax guide delivered to your inbox.

Please include name of person that directed you to my online tax guide so I can thank them personally.

Enter your Name, Email Address and a short message. We'll respond to you as soon as possible.

Anh Le, CPA and LTM Marketing Solutions, LLC are unrelated companies. This publication was prepared for the publication’s provider by LTM Marketing Solutions, LLC, an unrelated third party. Articles are not written or produced by the named representative.

The information and opinions contained in this web site are obtained from sources believed to be reliable, but their accuracy cannot be guaranteed. The publishers assume no responsibility for errors and omissions or for any damages resulting from the use of the published information. This web site is published with the understanding that it does not render legal, accounting, financial, or other professional advice. Whole or partial reproduction of this web site is forbidden without the written permission of the publisher.