SUBSCRIBE

Enter your Name and Email address to get

the tax guide delivered to your inbox.

Please include name of person that directed you to my online tax guide so I can thank them personally.

Anh Le, CPA, CGMA, EA, MBA

12400 Olive Blvd, Suite 320

Creve Coeur, MO 63141

Phone: 314-624-0350

Fax: 314-624-0351

Email: anh@anhlecpa.com

Website: www.lecpafirm.com

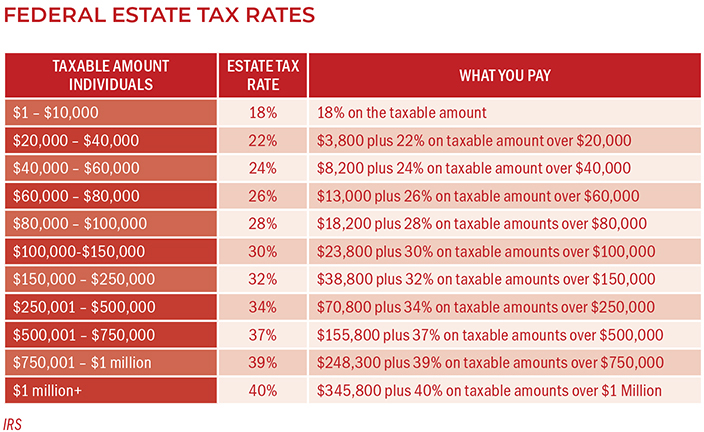

From an estate and gift tax perspective, the most significant change OBBBA made is a permanent increase to the estate, gift, and generation-skipping transfer (GST) tax exemption amounts. For 2026, these amounts are $15 million per individual or $30 million for a married couple (to be reviewed annually for inflation adjustments), up from $ 13.99 million per individual or $27.98 million for a married couple in 2025. The new legislation retains the TCJA-era tax brackets for trusts and estates. This means that for assets transferred during a lifetime or at death with a cumulative value exceeding the exemptions, the marginal tax rate remains 40% of the value over the exemptions.

A caution, though: Transferring assets to an irrevocable trust, a formerly popular strategy for transferring a family home, can take the trust assets out of the grantor's estate for all purposes. If the asset is no longer part of the grantor's taxable estate, it won't qualify for a step-up in basis. The assets in your irrevocable trust keep the same basis as when they are transferred to the next generation—or maybe to multiple generations. Be sure to review your trust arrangement with your estate professional.

Gifts to a non-US citizen spouse, however, are subject to limitations. Since a non- US citizen spouse may not be subject to the U.S. estate tax, one cannot transfer unlimited assets to a non-US citizen spouse, since that transferred wealth could potentially avoid U.S. estate taxation upon the non-US citizen spouse's death.

Thus, when the recipient spouse isn't a U.S. citizen, and regardless of whether the non-U.S. citizen spouse is a resident or nonresident of the United States, the amount of tax-free gifts is limited to an annual exclusion amount. For calendar year 2026, the first $194,000 (up from $190,000 in 2025) of gifts to a spouse who is a non-US citizen aren't included in the total amount of taxable gifts.

Enter your Name and Email address to get

the tax guide delivered to your inbox.

Please include name of person that directed you to my online tax guide so I can thank them personally.

Enter your Name, Email Address and a short message. We'll respond to you as soon as possible.

Anh Le, CPA and LTM Marketing Solutions, LLC are unrelated companies. This publication was prepared for the publication’s provider by LTM Marketing Solutions, LLC, an unrelated third party. Articles are not written or produced by the named representative.

The information and opinions contained in this web site are obtained from sources believed to be reliable, but their accuracy cannot be guaranteed. The publishers assume no responsibility for errors and omissions or for any damages resulting from the use of the published information. This web site is published with the understanding that it does not render legal, accounting, financial, or other professional advice. Whole or partial reproduction of this web site is forbidden without the written permission of the publisher.