SUBSCRIBE

Enter your Name and Email address to get

the tax guide delivered to your inbox.

Please include name of person that directed you to my online tax guide so I can thank them personally.

Anh Le, CPA, CGMA, EA, MBA

12400 Olive Blvd, Suite 320

Creve Coeur, MO 63141

Phone: 314-624-0350

Fax: 314-624-0351

Email: anh@anhlecpa.com

Website: www.lecpafirm.com

The steps you take today to prepare for retirement will shape your financial picture during your later years.

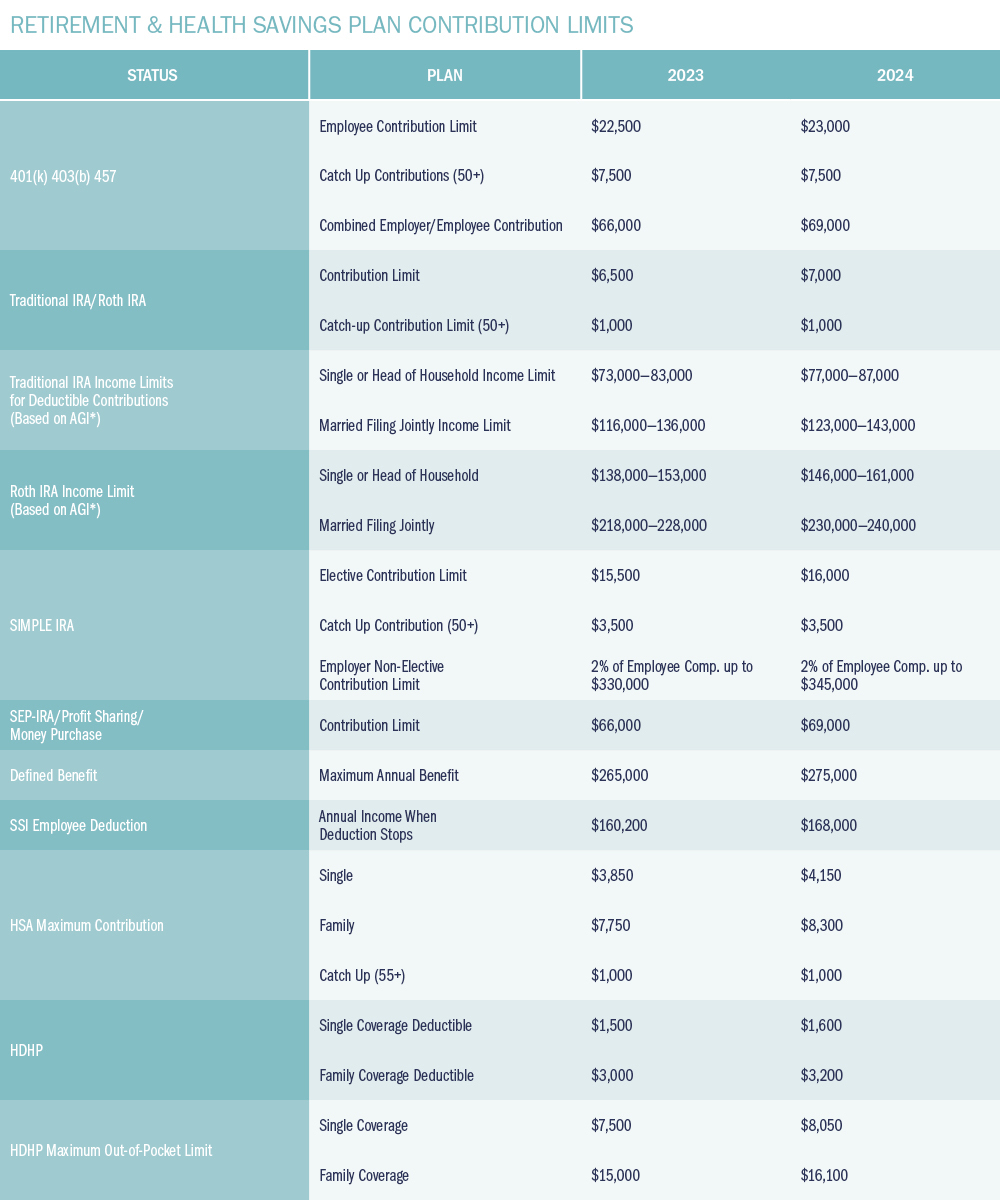

You have a variety of retirement savings vehicles to which you can contribute, depending on what your employer offers. These vehicles include traditional and Roth IRAs, Simplified Employee Pensions (SEPs), SIMPLE plans, and 401(k), 403(b), and 457 plans.

Contributing to most of these retirement vehicles may reduce your taxable income today while your money potentially grows tax-deferred over time. Time is key. The longer you contribute, the more likely you’ll be prepared for the retirement you want. At a bare minimum, you should try to contribute enough pay to take advantage of the maximum match your employer may make to your retirement savings account.

Contributing to a Roth IRA makes sense if you don’t need the tax deduction now or want tax-free distributions later. Tax-free income from a Roth IRA may permit you to leave other retirement accounts alone until you must take RMDs from them.

*Adjusted Gross Income (AGI), not taxable income

You may also want to consider rolling over a traditional IRA to a Roth IRA to avoid paying higher tax rates in the future. This makes sense for people who may have a relatively down income year but have the liquidity to pay the tax bill for that year without tapping a retirement account. A rollover may not make sense if you’re in a higher tax bracket now and planning to retire soon. You could end up paying more tax now than you might after you retire.

Enter your Name and Email address to get

the tax guide delivered to your inbox.

Please include name of person that directed you to my online tax guide so I can thank them personally.

Enter your Name, Email Address and a short message. We'll respond to you as soon as possible.

Anh Le, CPA and LTM Marketing Solutions, LLC are unrelated companies. This publication was prepared for the publication’s provider by LTM Marketing Solutions, LLC, an unrelated third party. Articles are not written or produced by the named representative.

The information and opinions contained in this web site are obtained from sources believed to be reliable, but their accuracy cannot be guaranteed. The publishers assume no responsibility for errors and omissions or for any damages resulting from the use of the published information. This web site is published with the understanding that it does not render legal, accounting, financial, or other professional advice. Whole or partial reproduction of this web site is forbidden without the written permission of the publisher.