SUBSCRIBE

Enter your Name and Email address to get

the tax guide delivered to your inbox.

Please include name of person that directed you to my online tax guide so I can thank them personally.

Anh Le, CPA, CGMA, EA, MBA

12400 Olive Blvd, Suite 320

Creve Coeur, MO 63141

Phone: 314-624-0350

Fax: 314-624-0351

Email: anh@anhlecpa.com

Website: www.lecpafirm.com

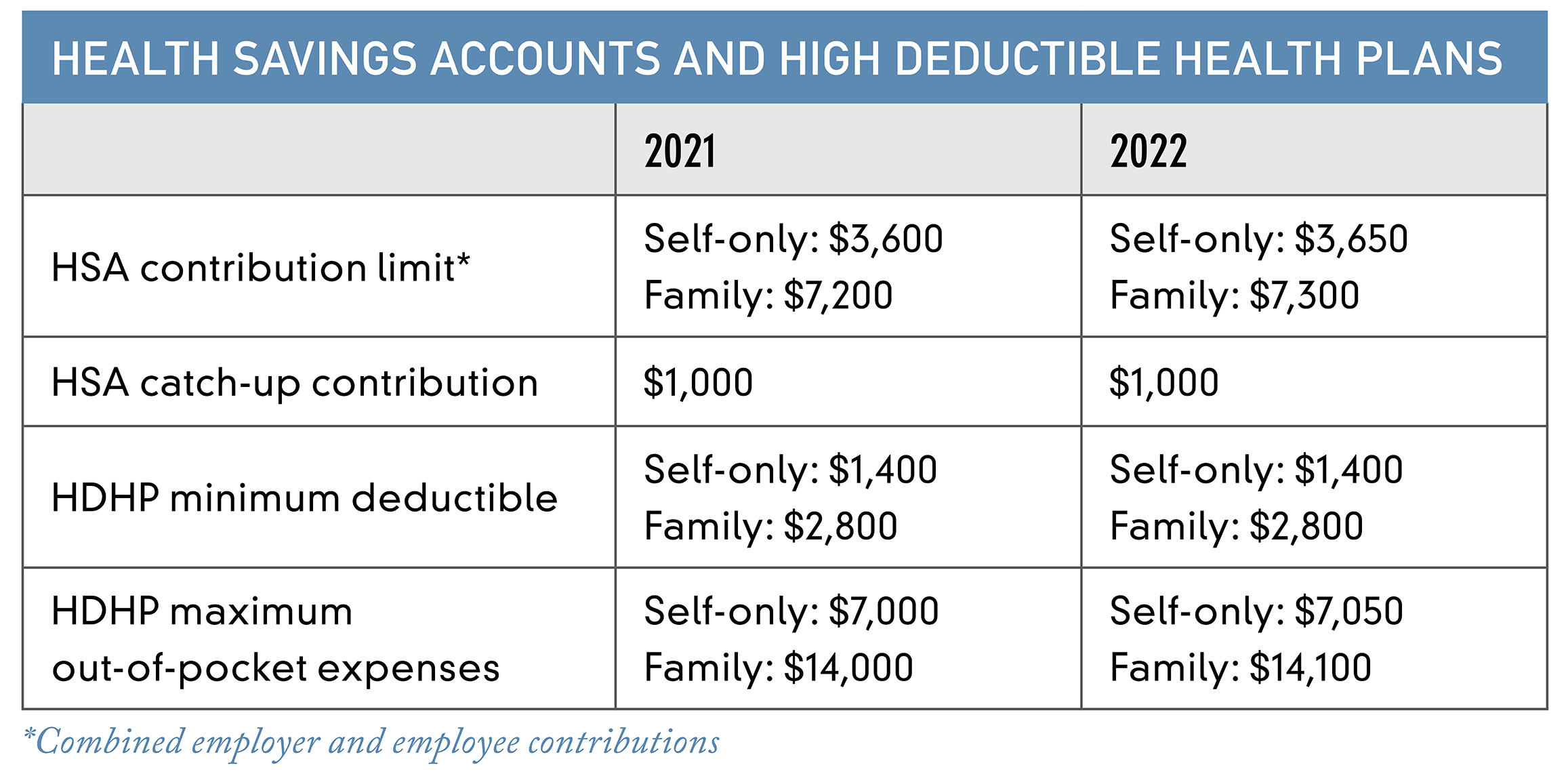

Some limits increased for Health Savings Accounts (HSAs) and their companion High-Deductible Health Plans (HDHPs).

HDHPs now cover remote health care services and costs of COVID-19 related testing and treatment before the annual deductible is met.

Also, HSAs now cover menstrual care products and over-the counter products and medications.

Enter your Name and Email address to get

the tax guide delivered to your inbox.

Please include name of person that directed you to my online tax guide so I can thank them personally.

Enter your Name, Email Address and a short message. We'll respond to you as soon as possible.

Anh Le, CPA and LTM Marketing Solutions, LLC are unrelated companies. This publication was prepared for the publication’s provider by LTM Marketing Solutions, LLC, an unrelated third party. Articles are not written or produced by the named representative.

The information and opinions contained in this web site are obtained from sources believed to be reliable, but their accuracy cannot be guaranteed. The publishers assume no responsibility for errors and omissions or for any damages resulting from the use of the published information. This web site is published with the understanding that it does not render legal, accounting, financial, or other professional advice. Whole or partial reproduction of this web site is forbidden without the written permission of the publisher.