SUBSCRIBE

Enter your Name and Email address to get

the tax guide delivered to your inbox.

Please include name of person that directed you to my online tax guide so I can thank them personally.

75 State Street, Suite 2105

Boston, MA 02109

617-753-9985

400 Crown Colony Drive, Suite 102

Quincy, MA 02169

617-422-0007

Website: www.pkfjnd.com

Income tax isn't the only tax that affects your spendable income. Be sure to take these taxes into account in your planning as well. Note any changes from 2025.

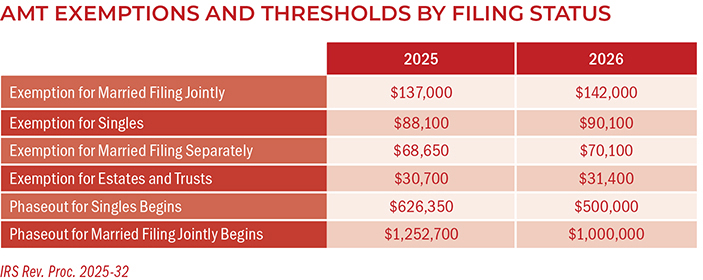

Before the TCJA, AMT had increasingly affected a broader range of taxpayers due to its different rules and exemption structure. TCJA reduced AMT exposure, but those relief measures shift under the OBBBA starting in 2026. As you see in the table below, for 2025, the phaseout of the exemption that single taxpayers may claim before AMT is imposed at $626,350 in AMTI. For married couples filing jointly, the phase begins at $1,252,700 AMTI.

Starting in 2026, however, OBBBA resets the exemption phase-out thresholds to the TCJA's $500,000 and $1 million AMTI, with annual inflation adjustments for 2026 and beyond. So, for 2026, these phase-out thresholds will be lower than in 2025. More bad news: OBBBA also increases the exemption phase-out percentage from 25% to 50%. As a result, more high-income individuals may be hit with the AMT, starting in 2026.

The AMT is complicated. Contact us to determine your status under the OBBBA changes.

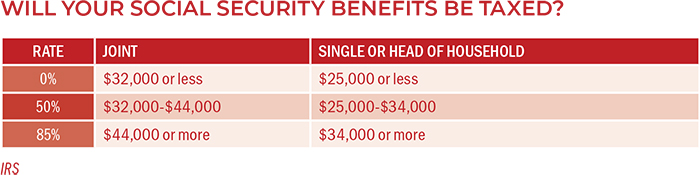

Some retirees may be taxed on up to 85% of their Social Security benefits. Check below to determine how much of your Social Security may be taxable for 2026. The provisional income referred to in the guide is your other taxable income plus tax-exempt interest and half of your Social Security benefit.

A new senior tax deduction created by OBBBA may offer a little relief. See Deductions and Credits for more details.

You will also owe an extra 0.9% for the Additional Medicare Tax if you earned more than $250,000 (married filing jointly), $200,000 (single, heads of household, and qualifying widow(er)s with a dependent child), and $125,000 (married filing separately) in a calendar year. Employers are typically responsible for withholding the extra tax.

*Converting a traditional IRA to a Roth IRA is a taxable event. A Roth IRA offers tax-free withdrawals on taxable contributions. To qualify for the tax-free and penalty-free withdrawal of earnings, a Roth IRA must be in place for at least five tax years, and the distribution must occur after age 59-1/2 or due to death, disability, or a first-time home purchase (up to a $ 10,000 lifetime maximum). Roth IRA distributions may be subject to state taxes.

Enter your Name and Email address to get

the tax guide delivered to your inbox.

Please include name of person that directed you to my online tax guide so I can thank them personally.

Enter your Name, Email Address and a short message. We'll respond to you as soon as possible.

PKF, P.C. and LTM Marketing Solutions, LLC are unrelated companies. This publication was prepared for the publication’s provider by LTM Marketing Solutions, LLC, an unrelated third party. Articles are not written or produced by the named representative.

The information and opinions contained in this web site are obtained from sources believed to be reliable, but their accuracy cannot be guaranteed. The publishers assume no responsibility for errors and omissions or for any damages resulting from the use of the published information. This web site is published with the understanding that it does not render legal, accounting, financial, or other professional advice. Whole or partial reproduction of this web site is forbidden without the written permission of the publisher.