SUBSCRIBE

Enter your Name and Email address to get

the tax guide delivered to your inbox.

Please include name of person that directed you to my online tax guide so I can thank them personally.

75 State Street, Suite 2105

Boston, MA 02109

617-753-9985

400 Crown Colony Drive, Suite 102

Quincy, MA 02169

617-422-0007

Website: www.pkfjnd.com

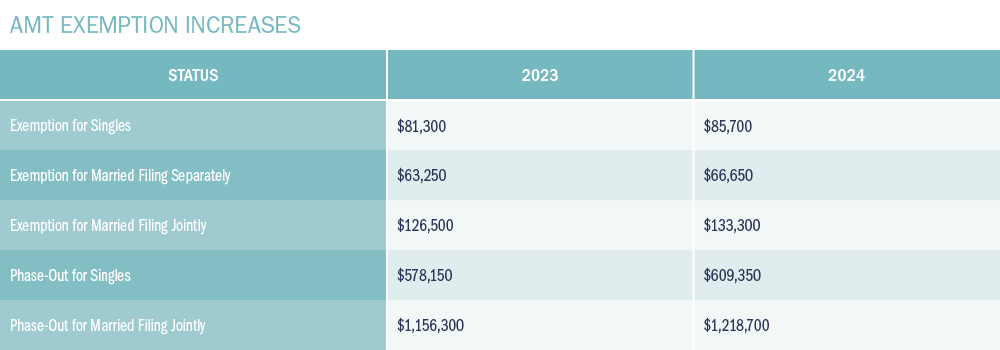

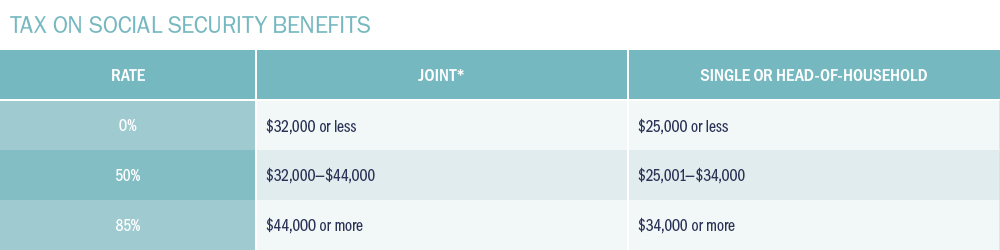

Income tax isn’t the only tax affecting your spendable income. Make a note of these taxes as well.

*The provisional income threshold is zero for married persons filing separately who do not live apart.

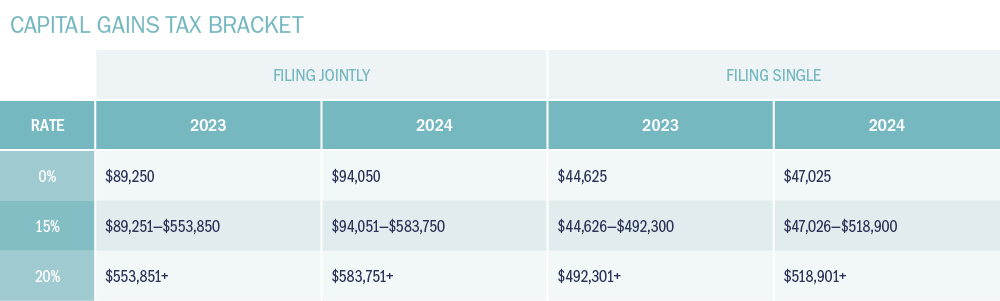

Even though the U.S. stock market had a good year in 2023, you may still have a security or two on which you’ve realized a capital loss. A capital gain or loss is the difference between your basis, typically the cost of buying an asset or investment adjusted by certain previous deductions for depreciation and depletion, and what you get for selling it.

If your investments have a net capital loss, you can deduct up to $3,000 of the loss against your income annually if filing jointly ($1,500 married when filing separately). If your losses exceed the annual limit, you may carry losses forward to future years, deducting up to $3,000 per year against your income until your capital losses are exhausted.

But keep the wash sale rules in mind. These rules prevent you from taking a loss on a security if you buy a substantially identical security within 30 days before or after the sale. You can avoid triggering the wash sale rules while maintaining the same portfolio allocations by selling the security and waiting at least 31 days before repurchasing it or selling the security and buying shares in a mutual fund that holds similar securities.

Qualified dividends are eligible for more favorable capital gains tax rates, while unqualified dividends are taxed as ordinary income. Generally, dividends from real estate investment trusts (REITs) are unqualified, as are those from credit unions and mutual savings banks.

You will also owe an extra 0.9% for the Additional Medicare Tax if you earned more than $200,000 in a calendar year, regardless of filing status. Employers are typically responsible for withholding the extra tax.

Enter your Name and Email address to get

the tax guide delivered to your inbox.

Please include name of person that directed you to my online tax guide so I can thank them personally.

Enter your Name, Email Address and a short message. We'll respond to you as soon as possible.

PKF, P.C. and LTM Marketing Solutions, LLC are unrelated companies. This publication was prepared for the publication’s provider by LTM Marketing Solutions, LLC, an unrelated third party. Articles are not written or produced by the named representative.

The information and opinions contained in this web site are obtained from sources believed to be reliable, but their accuracy cannot be guaranteed. The publishers assume no responsibility for errors and omissions or for any damages resulting from the use of the published information. This web site is published with the understanding that it does not render legal, accounting, financial, or other professional advice. Whole or partial reproduction of this web site is forbidden without the written permission of the publisher.